A study on the financial relationships, investments, and retirement prospects of millennials

The term “millennials” was coined because they were either turning twenty-one in the early years of the century or entering adulthood at the turn of the millennium. Because it was their first generation of people to be born in a digital world, those in this category are referred to as “digital natives.

Serving them has been a significant element in the growth of Silicon Valley and other IT hotspots. Their lives have always been dominated by technology. It’s been reported that they are on their phones as much as 150 times daily.

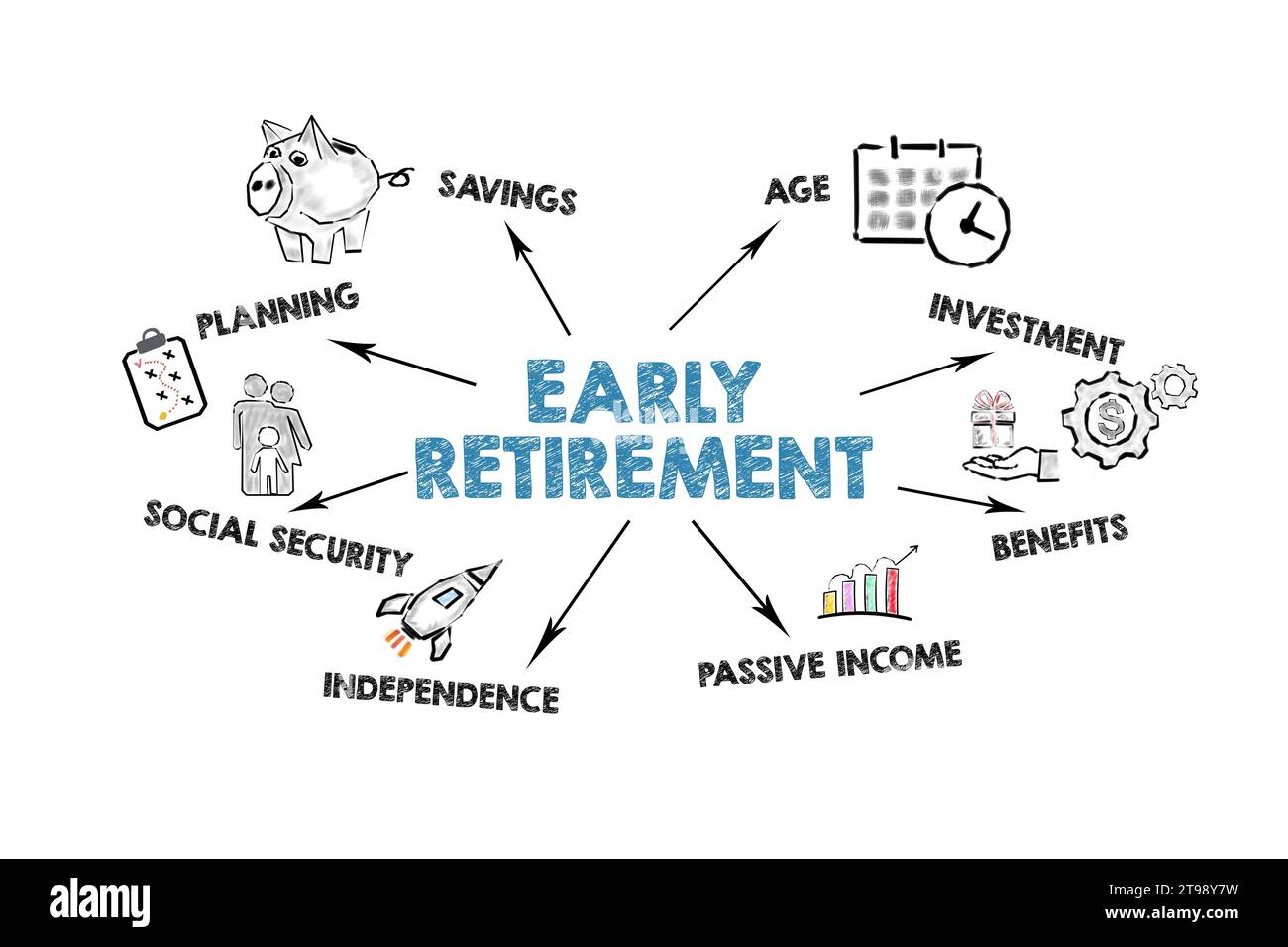

In light of how easy it is for young people to adapt to the changing times, what is their connection or attitude regarding retirement, investing, and finance?

Millennials Aspire to Financial Self-Sufficiency

Financial independence can be difficult to achieve when living paycheck-to-paycheck, like many younger generations of millennials, as well as Generation Z and their younger siblings. Earning money should be the main motivation for achieving independence, not spending less. It’s a bad decision to indulge in extravagant spending; reducing your Starbucks consumption will not result in you becoming rich. To make money, you need to have a more thorough plan.

They want to pay off their debt.

Reducing the amount of student loans is becoming more difficult, particularly for those who work. The importance of repaying debt as quickly as possible is normal; however, it may not be the most effective option. Your finances should also be working for you.

Utilizing the cash you have is a strategy to use to lower your monthly payment and begin saving cash for retirement. It is recommended to extend the term of repayment for the student loan. As you’ll have a long way left to wait before small sums of money begin to grow, compound interest is the best option for you once you’re in your 20s.

They want to put money aside for a major purchase.

Another goal is to conserve money for more expensive things, such as a house that one owns. Be aware that lenders know the importance of credit, money, as well as things such as stablecoins, crypt, and the significance of tether. That means that lenders are making more stringent requirements for large loans, specifically mortgages. This means that young people who are looking to purchase homes may need to pay a substantial amount of money.

Millennials’ Investing Methods

Even though millennials aren’t always at ease with investing, Social media platforms are making investing easier and more enjoyable for the current generation. They are investing in a different way than their parents and grandparents, so that they don’t have the same problems as previous generations. It shouldn’t be a surprise that young people are using various high-tech and digital tools for social networking to put their money into the investments of their choice because of their enthusiasm for everything tech.

Nowadays, they rely on the web, mobile apps, and social networks for everything from finding financial advisors to purchasing stocks in accordance with the advice of. Prospectus for millennials is a great way to peruse for advice, get a copy of a prospectus, and even make a purchase with just a few phone clicks. They encourage businesses to allow them to do this. The financial decisions of millennials are usually heavily influenced by things like social and environmental accountability.

Wrapping it Up

Certain millennials might mix fun and travel during their working years if they don’t anticipate having a major financial change from their work. Since they’ve experienced the recession or watched their parents suffer, millennials could have a set of values that push them to be financially responsible and prioritize spending, save at least one annual vacation, and participate in exciting new activities and experiences whenever they can.